Kenya projects over 5% economic growth in 2021 – African Development Bank

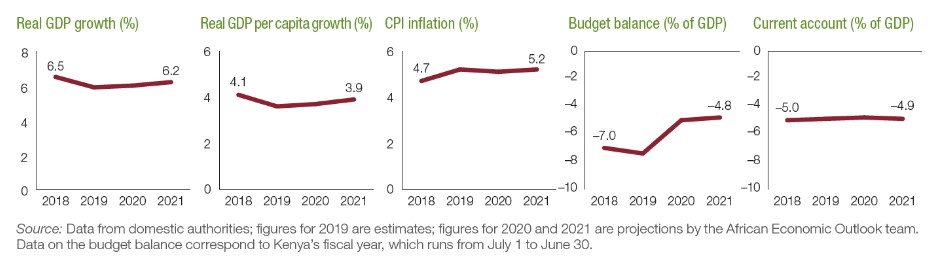

Kenya's economy has obviously been impacted by the 2019 Corona Virus Disease (COVID-19). The pandemic has had tremendous repercussions to the business environment throughout 2020. The African Development Bank reported a 5.9% growth in the GDP in 2019 with a projected 6% in 2020. Separately, Genghis Capital also forecast a similar growth trajectory. They project about 5% growth in the Second half of 2021, after a sluggish start owing to Covid-19 pressures.

Covid-19 Vaccine Rollout spells hope for Kenyan Economy

There have been global efforts to mitigate the spread and impacts of the virus. These efforts have resulted in record-breaking vaccine production in the scientific community. As at January 2021, vaccines have been authorized and recommended to prevent COVID-19 including Pfizer-BioNTech COVID-19 vaccine and Moderna’s COVID-19 vaccine. Others in the pipeline include:

- AstraZeneca’s COVID-19 vaccine

- Janssen’s COVID-19 vaccine

- Novavax’s COVID-19 vaccine

These developments have increased the optimism towards a resumption to some sense of normalcy in the social and business environment. Governments and local authorities may gradually relax the COVID-19 related restrictions. In the Kenyan perspective, Reuters reports that we will be receiving up to about 24-million vaccine doses around the second week of February. This initiative was made possible in partnership with the African Union to ensure African countries are not left behind in the Vaccine rollout. Notably, the first targets for the vaccine rollout will be health workers and teachers. As such, the arrival and rollout of the vaccines potentially signal movement towards relaxation of the COVID-related restrictions.

Sluggish private consumption may slow down recovery

The growth projection by Genghis is 60 basis points lower that pre-COVID average growth rates of 5.6%. The optimism in the positive growth projection is a breath of fresh air given the reports that Kenya sunk to negative economic growth in June 2020 for the first time in 20 years. This was marked by significant company closures, thousands of layoffs and job losses following the near-global shutdown to curb the spread. A sluggish private sector consumption has been anticipated in 2021 and poses negative risks to economic recovery.

Future Investment decisions greatly influenced by COVID post-pandemic

Arguably, no one could have predicted that at one point, the entire global economy would be weighed down and held captive by a single global biological phenomenon. The pandemic impacted global travel with airlines grounded for several months for the first time ever! This impacted economies in the developing world greatly owing to their huge reliance on tourism. In Kenya, 2020 registered significant exit of foreign investors from the NSE. This was after positive flows in 2019 following the anticipated impacts of new tax legislations, and the COVID 19 restrictions to the business environment.

On the flip-side, the 'sell-off' implies that for the majority of stocks on the NSE, the prices are ideal for long-term investors. The sell-off from across the majority of the stocks deflated the Nairobi All Share Index (NASI) by 8.7 per cent to 152.11 points.

Scribe Services Registrars Limited offers Advisory and technical support as registered Nominated Advisors (NOMADS) to companies that want to list in the Growth Market Enterprise Segment. We assist such entities to raise the capital needed in order to grow and ensure their compliance with all rules and regulations set by the NSE.